Important Updates and Changes to ERTC Quick Guide for the Year 2022

ERTC Quick Guide for the Year 2022

The ERTC Quick Guide for the Year 2022 is actually a crucial source for all people as well as companies that are actually associated with emissions trading. This manual supplies necessary details concerning key updates and also modifications to the requirements of discharges trading systems, as well as ideal strategies for conformity. The guide is actually made to assist organizations and also people know the vital decisions they have to make to capitalize on the benefits of emissions exchanging, as well as exactly how those choices may favorably influence their profits.

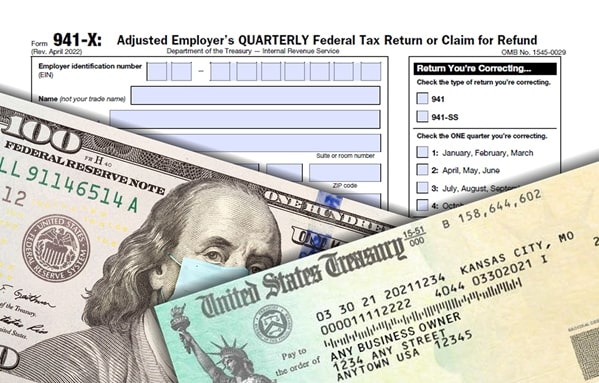

The ERTC Quick Guide for the Year 2022 includes in-depth summaries of the different sorts of emission credit ratings on call, as well as essential changes to needs for emissions exchanging. It also offers direction on how to carry out a successful compliance plan as well as supplies absolute best process for observance. Moreover, the quick guide deals with necessary modifications to the reporting needs linked with exhausts trading programs. Important updates and changes to ERTC for the year 2022

Updates to Tax Credits and Deductions

The ERTC Quick Guide for the Year 2022 additionally features significant information regarding improvements to tax credit ratings and deductions accessible when trading emissions. This includes descriptions of brand-new deductions, and also adjustments to existing ones. It is necessary for associations and individuals engaging in exhausts trading to comprehend these adjustments so as to maximize their chances of success.

In general, the ERTC Quick Guide for the Year 2022 is actually a vital resource for those associated with discharges exchanging. It offers essential updates and adjustments to the needs of emissions trading systems, and also best practices for compliance. When interacting in exhausts exchanging, by recognizing these updates as well as observing best techniques, associations and also individuals may boost their odds of success.

Adjustments to Filing Requirements

The ERTC Quick Guide for the Year 2022 supplies necessary relevant information regarding adjustments to declaring demands linked with emissions trading. This features brand new kinds as well as records that must be actually submitted along with appropriate authorities, in addition to changes to existing filing criteria. It is actually essential for those taking part in emissions trading to know these modifications in order to make sure compliance as well as stay clear of costly penalties.

In general, the ERTC Quick Guide for the Year 2022 gives an extensive outline of the essential updates and adjustments to emissions trading courses. When engaging in emissions trading, it is actually a very useful information for companies as well as people searching to optimize their opportunities of success. By recognizing these updates and complying with best practices, they may guarantee that their initiatives are actually cost-efficient and also compliant.

To read more concerning the ERTC Quick Guide for the Year 2022, satisfy contact your nearby exhausts trading authority. They will definitely be able to offer you with additional tips and also advice pertaining to any sort of updates or even modifications that might impact your company or even individual activities.

New Rules for Self-Employment Taxes

Furthermore, the ERTC Quick Guide for the Year 2022 features a review of brand-new guidelines for self-employment taxes. This is vital details, as improvements to self-employment income tax laws can have a considerable effect on those participating in exhausts exchanging. It is important that individuals as well as organizations recognize these adjustments to guarantee conformity as well as prevent pricey fines.

On the whole, the ERTC Quick Guide for the Year 2022 is a very useful source for those involved in discharges exchanging. It gives vital updates as well as adjustments to the needs of exhausts trading courses, and also ideal strategies for observance. When engaging in exhausts trading, by understanding these updates and also adhering to absolute best people, techniques and also companies may boost their opportunities of results.

To learn more concerning the ERTC Quick Guide for the Year 2022, feel free to contact your local discharges trading authorization. They will certainly be able to deliver you along with extra recommendations and also support concerning any sort of updates or modifications that might influence your institution or even personal tasks. Many thanks for utilizing our manual as well as our company wish you effectiveness in your undertakings!

Improved Benefits for Retirement Plans

The ERTC Quick Guide for the Year 2022 features info concerning enriched perks for retirement life plans. This consists of brand-new regulations as well as laws that need to be actually succeeded to make certain that retirement life contributions are up to date with current criteria. When handling their retirement plans, it is vital for those involving in exhausts trading to understand these changes in order to maximize their possibilities of effectiveness.

Overall, the ERTC Quick Guide for the Year 2022 provides a thorough guide of the essential updates as well as changes to discharges trading plans. It is actually a vital information for companies as well as people wanting to maximize their chances of success when taking part in exhausts investing. By knowing these updates and complying with greatest practices, they can easily guarantee that their initiatives are actually cost-effective and also up to date.

For additional information regarding the ERTC Quick Guide for the Year 2022, please contact your neighborhood exhausts trading authority. They will be able to deliver you with additional advice and also advice relating to any type of updates or even improvements that might affect your association or even private activities. Many thanks for using our resource as well as our company desire you effectiveness in your ventures!

Upgraded Guidelines on Home Office Deduction Eligibility

The ERTC Quick Guide for the Year 2022 additionally consists of improved standards on home office deduction qualification. This segment of the guide provides relevant information on adjustments in qualifications criteria and also provides ideal methods to make certain conformity with these brand new guidelines. It is actually crucial that people and institutions comprehend these updates if you want to maximize their opportunities of effectiveness when asserting rebates connected to exhausts trading tasks.

Overall, the ERTC Quick Guide for the Year 2022 delivers a comprehensive guide of the crucial updates and also improvements to discharges trading courses. It is an important resource for people and also associations trying to optimize their odds of excellence when participating in discharges exchanging.

The ERTC Quick Guide for the Year 2022 features detailed descriptions of the a variety of types of exhaust credit scores accessible, as properly as necessary changes to criteria for emissions exchanging. The ERTC Quick Guide for the Year 2022 additionally features important info regarding changes to tax credit ratings as well as rebates readily available when trading discharges. The ERTC Quick Guide for the Year 2022 supplies crucial info regarding improvements to submitting criteria affiliated with emissions trading. Overall, the ERTC Quick Guide for the Year 2022 supplies a comprehensive overview of the crucial updates and also improvements to emissions trading plans. In general, the ERTC Quick Guide for the Year 2022 provides a detailed overview of the essential updates as well as improvements to emissions trading programs.